Industry News & Events

China’s app store market is fragmented, but business is still booming

Mar 21, 2018

Industry News & Events

China will produce $1 trillion in m-commerce in 2018, much of it flowing through alt app stores.

China is now the world’s leading global app market by more than 15% over the the US. China is also top in terms of highest average m-commerce spend. The App Store records twice as many monthly downloads as its nearest competitor (Tencent’s Myapp as of this writing), but no one app store truly dominates the app market in China.

Android is increasing its share of device sales in China, but Google Play is blocked in our country, leading to the problem of app store fragmentation. Today, there are several Android app stores including Qihoo 360, Xiaomi Market, Baidu, Huawei, etc.

Each of these local entrants holds between 10 to 15% market share. In total, about 57% of all app users in China go through one of these third party app stores, which is a wildly different, more competitive landscape than in the US. But competition doesn’t seem to be hurting business.

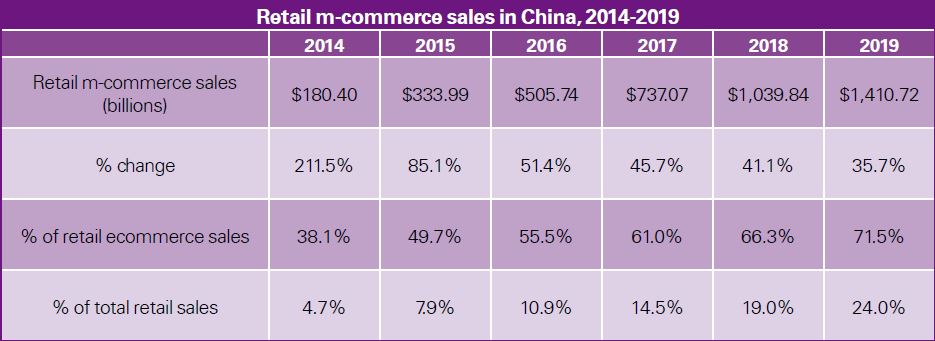

Buoyed by the common practice of businesses communicating with consumers through branded apps, in-app commerce in China is strong. In fact, by 2019, mobile users in China are expected to spend nearly $1.5 trillion via m-commerce–nearly 8x growth since 2014, and better than 71% of all e-commerce in China.

Source: China’s Mobile Consumers And The Rise of Chinese M-Commerce

Source: China’s Mobile Consumers And The Rise of Chinese M-Commerce

The sheer size of the market makes room for all the competitors, but what’s behind the astonishing e-commerce growth rate in China? Rapid smartphone adoption, high consumer confidence, and ubiquitous mobile payments, for starters.

With a population approaching 1.4 billion, smartphone penetration nearing 60%, and more than 713 million e-commerce app users, we are in a class of our own in China. This extraordinary market has formed as the result of several converging market dynamics. Most significantly, a polished and mature mobile payment ecosystem that has won trust from both users and merchants alike.

Alipay and WeChat Pay dominate with 90% of the mobile payments market share, while traditional payment networks such as MasterCard largely participate in mobile payments so as to avoid being entirely disintermediated. Mobile payments have become such an embedded part of business (in-store and out), that payments have evolved beyond simple transaction utility to offer retailer and etailers a means to leverage data in order to increase sales, enhance customer engagement, and fortify brand marketing.

Mobile payments also enjoy a high degree of consumer confidence in payment security, as well as convenience and accessibility. Quoting an article on Sampi.co:

“Chinese m-commerce has leveled the playing field for all types of consumers regardless of location. While physical stores of some brands may not be available in 3rd and 4th tier cities, the shoppers can still gain the same access to brands as that available to people living in major cities.”

From a behavioral standpoint, understand that Chinese app users spend significantly more time in-app than in other parts of the world, researching products, checking prices, and engaging with brands, even within those brands’ physical shops. This sort of mobile behavior will gain momentum as leading e-commerce brands like Taobao introduce new app features, such as one-touch ordering directly from a photograph, and refine tactics, including push notification remarketing.

Yet, even though revenues surge amid seemingly ideal market conditions and app publishers become ever-more skilled curators of mobile experience, we must check our enthusiasm for China’s app market with a dose of pragmatism. The foreshadow of government regulation and potential for consolidation in the app store market may soon make competing in China more difficult.

In a nutshell, China is a prototypical large, growing, and fragmented market ecosystem, and one way or another, it’s about to change. Greater government oversight looms and cybersecurity issues are a legitimate concern in China. How will this play out in the context of current growth trends?

Moreover, while shopping, the exchange of monetary gifts, and even complex banking transactions are common experiences in China, the long-term value for brands and publishers is in understanding the behavioral data around those experiences.

Certainly, arming every developer, brand, and investor with transparency into how they can use this information to build better products, enhance shopping experiences, and personalize payment processes could help China’s already stunning app economy grow even our imaginations—fragmented or otherwise.