Japanese consumers are generally risk-averse when it comes to mobile payments, letting mobile devices (operating systems, apps, etc.) store payment information, or providing much personal information at all.

To an aged population with low smartphone penetration rates among those over 60, mobile payments probably seem suspect, at least.

This reluctance toward mobile-first payments by a prominent segment of the population means more “traditional” methods, such as NFC-powered contactless payments win out.

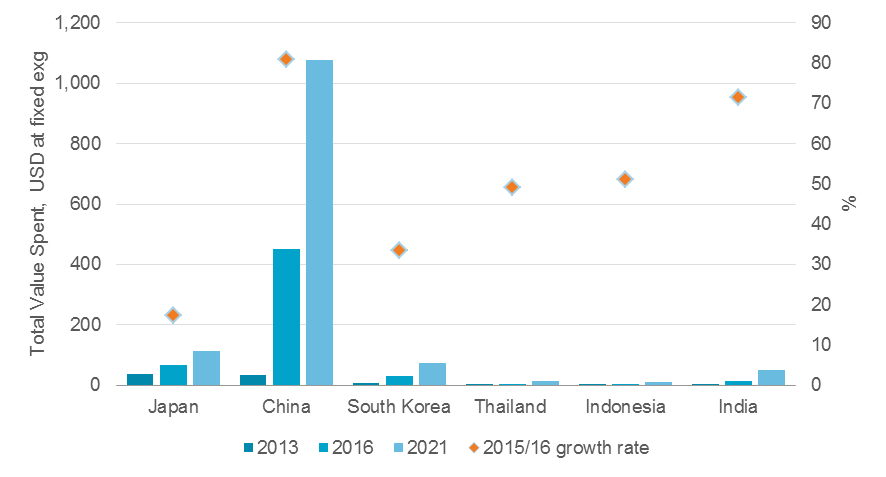

Mobile Digital Purchases in Asia Pacific, Total Value Sales, 2013-2021

Source: Euromonitor International

While contactless cards have only been adopted with the introduction of NFC terminals, they’ve been used in Japan for more than 20 years and they work just fine. That said, contactless is really the foundation for unleashing mobile payments in Japan. We see a similar phenomenon in Vietnam where the cultural norm of cash on delivery for all transactions is essential to bake in to mobile market success.

In Japan, the average person has three contactless cards, which is much higher than elsewhere in APAC. It’s no surprise then that prominent mobile payment brands like Edy offer their own contactless cards. Additionally, Apple Pay recently added support for Suica, one of the biggest contactless card companies in Japan. Shoppers can use Suica as a proxy for other credit cards, which is a big step in helping mobile payments become more widely adopted.

It’s clear Japan’s contactless card culture isn’t going anywhere anytime soon, but the issue isn’t just support for cards. The challenge is building mobile-friendly ways for consumers to uses contactless payments and clear the Japanese consumer’s high trust barrier. To do so, innovators should find ways to bridge the divide between what are typically thought of as transaction and experience.

One example of this would be for a trusted brand to use mobile notifications to offer customers loyalty rewards for their contactless card account, like offering concert goers a seat upgrade and a walking map to help find those seats via their phones. And all of this would be paid for easily with a trusted mobile wallet experience while en route. The channel to power this experience could be a popular messaging app, like LINE. The app has over 217 million active users, offering a huge opportunity for its LINE Pay mobile payments platform to get in front of a large audience.

The recurring theme for developers is to find the touch points between what Japanese consumers trust and what they may be interested in using their mobile devices and cards for. One such touch point is video ads, as the ad format is steadily growing in Japan. An example of this would be giving customers a discount on their tea by watching a video ad while waiting for it to be made. This takes the concept of rewarded video in mobile games and translates it into real world products and services.

Even as the average Japanese mobile consumer continues to evolve, so does the market’s growing expectations of mobile ads. According to eMarketer’s 2017 report, “2017 was a milestone year for mobile in Japan. For the first time, the format accounted for more than half of digital time spent (57.2%) and ad spending (56.1%). As more adults in Japan trade in their feature phones for smartphones, growth in mobile ad spending will continue to rise throughout the forecast.”

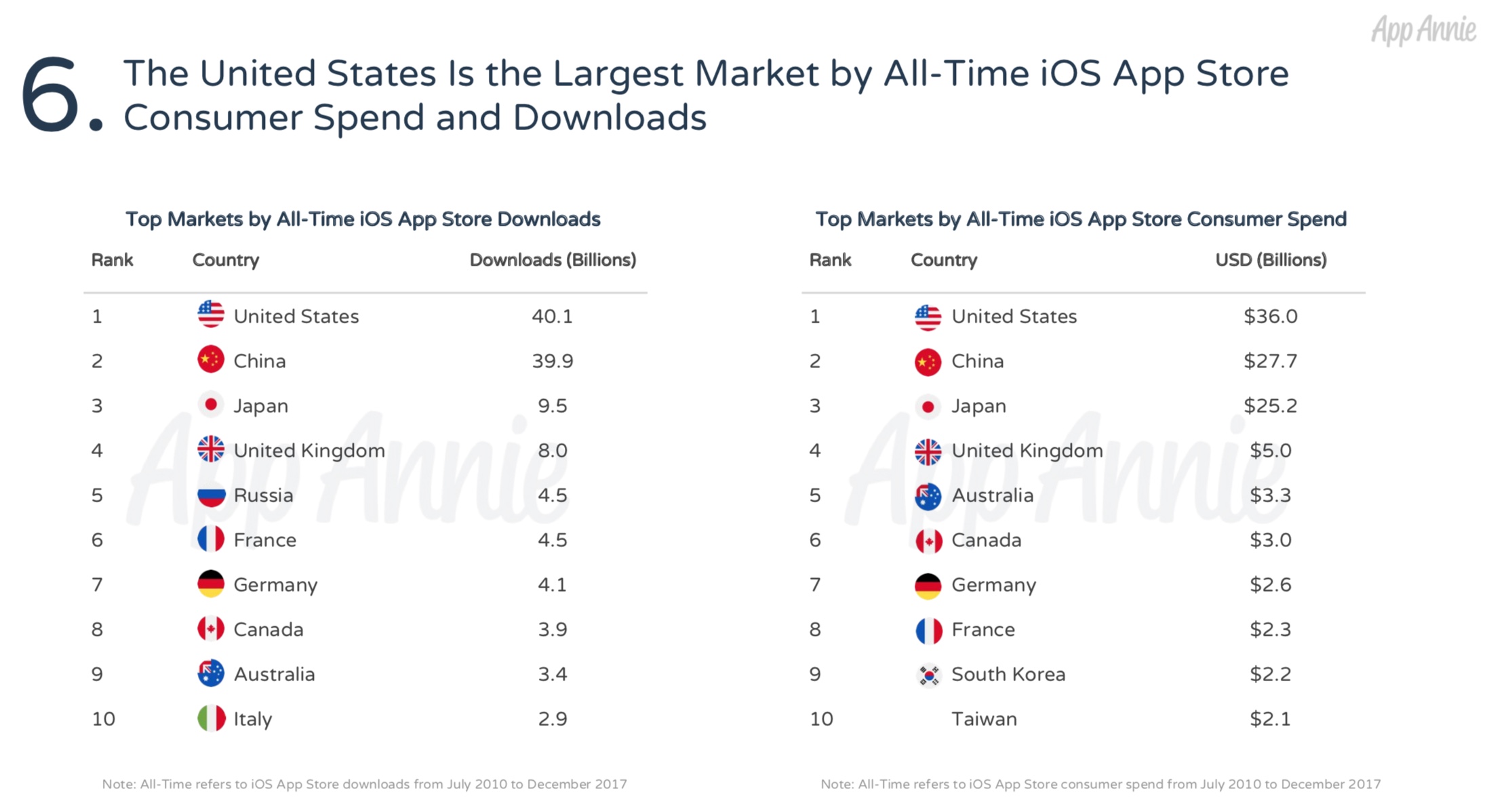

Source: App Annie

While mobile payments per se may yet remain modest in Japan, there is certainly room for growth in feeding consumers’ desires for mobile content, apps, and experiences. Although the country lags in app downloads compared to the US, Japan’s App Store revenue is neck and neck.

While today’s Japanese mobile consumers don’t yet address payments in the most convenient of ways, they are most certainly mobile natives in many other regards, and they’ll offer mobile marketers many opportunities in the future. That said, Japanese brands and developers must find innovative ways to make trusted technologies like contactless cards even better for Japanese consumers. But it would be short sighted to use mobile payments as the best or only measuring stick for Japan’s mobile consumerism.

Finding new perspective at the intersection of old consumer trusts and new mobile experiences, and figuring out how to monetize that efficiently via any method, is the bigger-picture way to discuss the Japanese mobile economy.