Industry News & Events

How Marketers Can Shake Up the App Economies in Vietnam and Argentina

Feb 21, 2018

Industry News & Events

In my first article examining the app market mechanics of Vietnam and Argentina, I talked about how establishing app economies is a smart move in these countries because the industry doesn’t need much investment to get going.

Both the Vietnamese and Argentinian governments, as well as corporations, are investing in mobile, which is a good indication of the stability of each country’s app economy. While this and a growing contribution to each nation’s GDP are clearly part of the macroeconomic story of apps in Vietnam and Argentina, in this article I’d like to focus on a few select market categories and offer key indicators that illustrate the unique user behaviors influencing each economy. Specifically, I’ll zero in on gaming, shopping, and payments.

A quick look at the data will tell you that gaming is king for users in Vietnam, whereas social and shopping rule in Argentina. Users in both countries are adopting mobile transactions in their own ways.

Mobile marketers of all stripes in Vietnam are trying to engage hard-to-capture demographics—particularly females aged 18 to 35 with a penchant for playing all types of mobile games, from casino slots to casual games and eSports.

Though users may not be not sold on using their smartphones as transaction devices, a growing number of good user experiences are making them trust mobile more as part of their consumer journeys (brand marketers take note). As a result, good shopping apps with local resonance, like Lazada and Shopee, are becoming a trusted way to buy clothing, groceries, electronics, and beauty products.

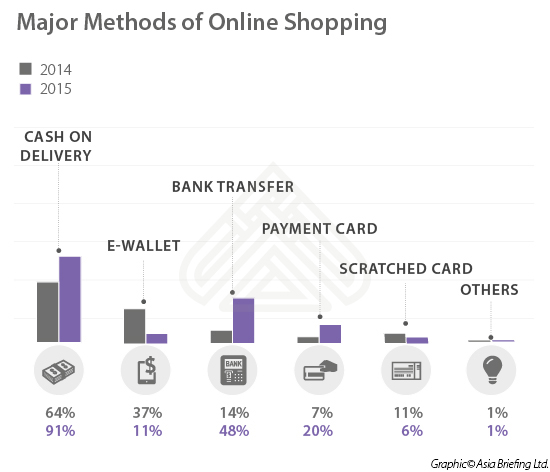

Source: Vietnam Briefing

The mobile payments market is flooded with different mobile payment options, but the key to growing engagement around mobile payments in Vietnam isn’t about proving even more options; it’s refining the payments experience to the Vietnamese embedded norm of cash on delivery for all transactions.

Electronic bank transfers are gaining popularity, but a lack of interest in debit cards, credit cards, and mobile wallets means Vietnamese users may remain modest adopters of mobile payments for the time being. For now, the mobile payment landscape is saturated by too many players, preventing a default mobile payment method from emerging.

Over in Argentina, where mobile payment infrastructure and its use cases are center stage, it’s a bit of a different story. Market consolidation is already under way, and Argentina’s sophisticated mobile users are about to leapfrog desktop payments into a whole new financial reality.

In Argentina, the national focus is on realizing the potential of the excellent digital and mobile payment infrastructure it has established as part of the country’s economic re-creation. The mobile app economy is expected to account for 65,000 to 80,000 jobs in Argentina by 2020. Local content and app development contribute greatly to that number. Success stories include MercadoLibre, a LATAM m-commerce giant and Globant, an experience architect for the likes of Zynga and EA.

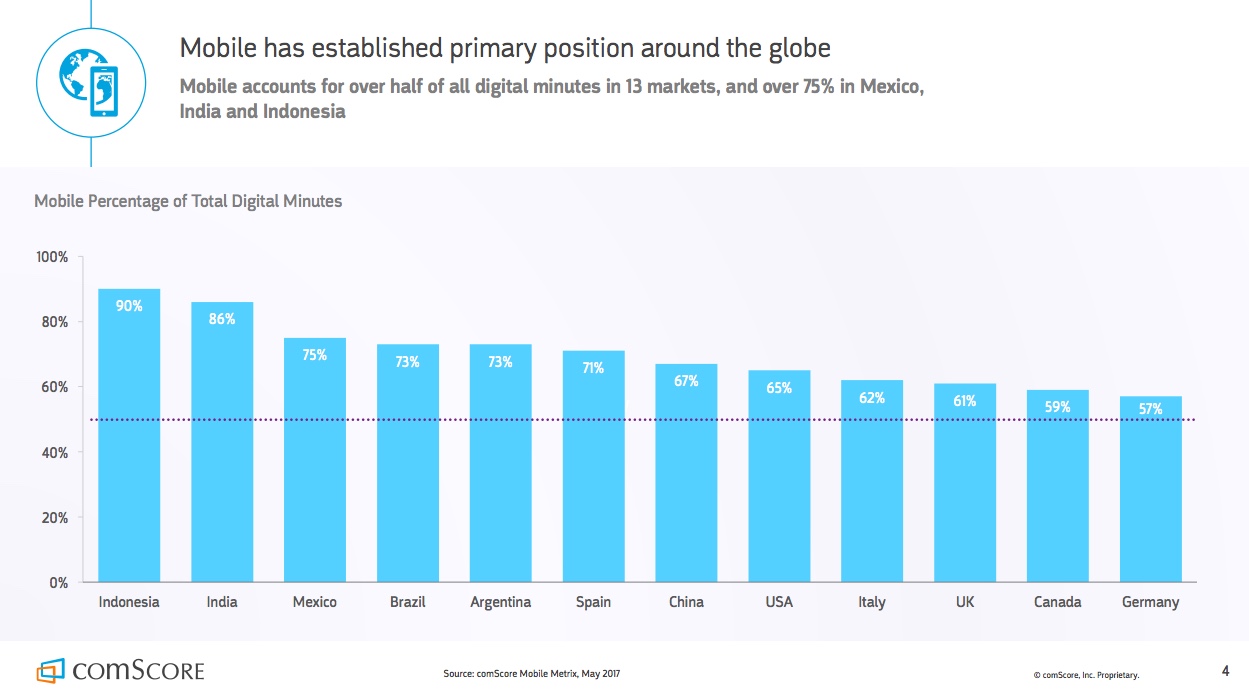

The average mobile user in Argentina is everyone—there’s been 100% penetration there since 2008—though women are more likely to be mobile-only. Users in Argentina have been traditionally challenged by unreliable network speeds, but that’s getting much better. Data indicates [PDF] that improving infrastructure is expected to drive mobile data traffic to grow at CAGR of 49% between 2015 and 2019.

That traffic growth will help increase average revenue per user (ARPU), which has grown steadily since 2012. This isn’t surprising, given that users in Argentina lead the globe in per-person mobile minutes of usage and they prefer apps over the mobile web. Gaming is a favorite category there, as in Vietnam, but social apps reign supreme in Argentina.

It’s predicted that users’ trust of mobile in Argentina will increase mobile payment adoption there, meaning many users will go from “unbanked” to mobile-first consumers. Perhaps Argentina can apply this learning to model a unique mobile payment experience that other developing markets can learn from.

Certainly, there’s an executable game plan for each country to grow its mobile economy in accordance with its core strengths.

For marketers and publishers in Vietnam, the key to putting more mobile revenue in your pockets is keeping pace with the Vietnamese user’s love for gaming. Casual gaming apps dominate both free and paid options, and eSports is making an early breakthrough. Because much of monetization is through ads, quality is important, and it’s crucial to maintain a good user experience while maximizing player touchpoints, like a skippable video after one or several game loops.

While the future is bright for Argentina’s mobile economy, overcoming a long history of old problems may boil down to scoring an early goal: making mobile payments easy for users who’ve never even had a bank account. The audience in Argentina isn’t huge (40 million), but the country is a mobile-obsessed nation with a tangible investment in its mobile economy, and it’s a strong entry point to the rest of LATAM, including Mexico and Brazil.

While casual experiences (games, messaging, and social) have users’ attention, it is the most innovative solutions for powering in-app mobile payments and programmatic ads that are poised to shake up each app economy.